The debt ceiling (debt limit) is a concept/norm that has been used since 1917, which serves to control the total amount of debt a government can gain “before” it defaults or lacks liquidity. A country’s legislative branch (parliament or Congress) allows the debt ceiling figure. Congress determines this figure in the United States, which has increased 78 times over the last 70 years. Below, we will learn why Bitcoin benefits from the U.S. “debt ceiling.”

Purpose of the debt ceiling

The debt limit arose as a tool to regulate the public indebtedness of a government in the United States; this figure forces legislators to be fiscally disciplined and responsible, controlling government spending and the value of taxes, creating a balance that allows controlling the debt that could lead to a default or lack of payments.

What happens when the debt ceiling is reached or exceeded?

Suppose the United States government reaches or exceeds its debt ceiling. In that case, the government will default on its payments and obligations: payments to Social Security beneficiaries, payment to people who have purchased bonds, etc. In addition, this situation may harm the country’s credit rating, which would mean a decrease in the demand for U.S. Treasury bonds, and a significant increase in interest rate, negatively affecting the global financial system and many countries and trading partners that depend on this economy.

Internally, reaching these instances would mean a severe economic crisis that would be automatically reflected in the financial markets within the United States, reducing the ability to get personal and business loans, leading to the closure of some companies and a significant reduction in jobs.

We should consider that for many years, the United States has been characterized for being a country that pays all its debt, thanks to the historical solvency of the U.S. Treasury securities, which has generated great confidence in investors and even in some emerging economies, turning the U.S. Dollar into a world reserve currency. However, if there is any cause that generates a lack of confidence in the dollar, then it could become a factor that leads investors to sell their Treasury bonds, which would cause a weakening of the dollar and generate uncertainty and a debt crisis for emerging economies, especially those that keep their foreign currency reserves in U.S. Dollars.

Debt ceiling history

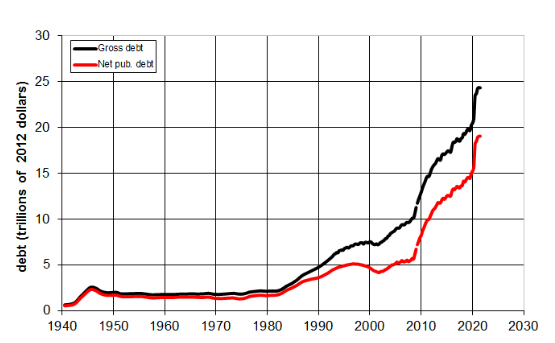

Unfortunately, the track record of the United States debt ceiling is not favorable, as Congress has acted 78 times to permanently rate, temporarily extend, or revise the definition of the debt limit, which is not a good sign, as that track record marks a tendency to solve problems by “raising” the debt ceiling without solving the underlying problem: over-indebtedness, mismanagement, and increased spending.

Why does the U.S. Debt ceiling benefit Bitcoin?

The U.S. Debt ceiling directly influences the global economy and financial markets, which can affect Bitcoin and other cryptocurrencies. Below, we share some reasons the United States Debt ceiling can benefit Bitcoin:

Devaluation of the U.S. Dollar: If the debt ceiling is not raised and the U.S. government cannot meet its payment obligations, it could cause a lack of confidence in the U.S. Dollar, resulting in a devaluation of it. In this environment, many investors, companies, and individuals may seek refuge in alternative assets such as Bitcoin, which some see as a “store of value” and a hedge against inflation.

Financial Uncertainty: The discussion and debate that usually occurs in Congress and different official media (around the U.S. Debt ceiling) may generate uncertainty and instability in the financial markets. In this environment, some investors, companies, and individuals may look for safer assets or investment alternatives outside traditional currencies, for example, Bitcoin, which could attract interested investors to diversify their investment portfolios or hedge against financial uncertainty.

Institutional adoption of Bitcoin: Uncertainty related to the debt ceiling may drive the institutional adoption of Bitcoin. Recent years have seen growing interest in Bitcoin by some financial institutions and companies to diversify their investments and hedge against the risks of the traditional financial system. If the uncertainty increases because of the debt ceiling, more institutions and companies may consider investing in Bitcoin to hedge before a crisis.

What do you think about this topic? Would you like to know more about Bitcoin?

If you are interested in our products or services, you can visit our website and register on our platform by visiting the following link.